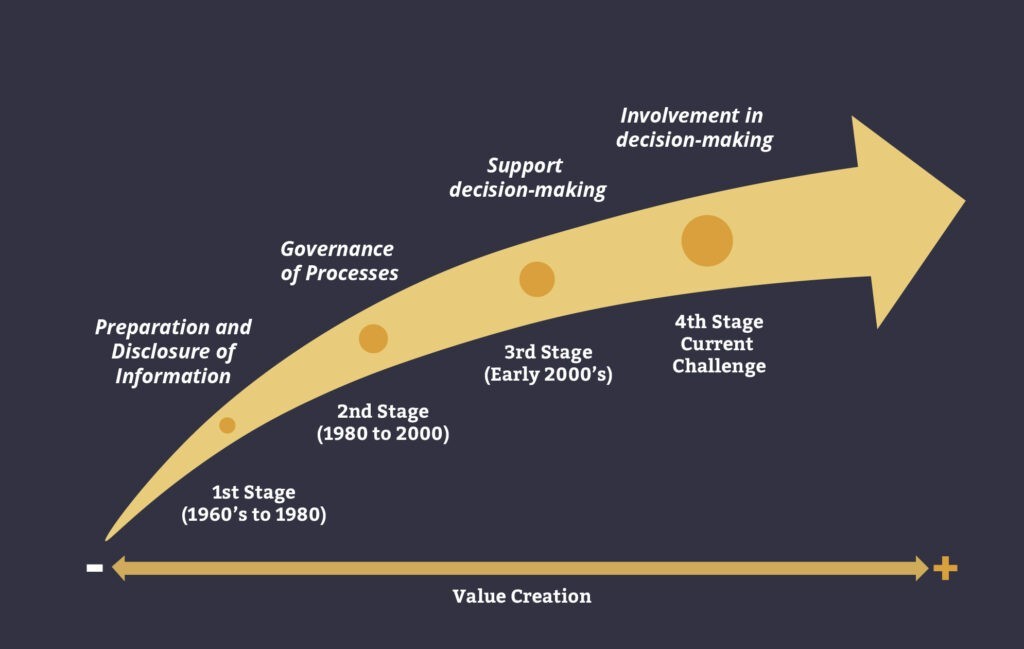

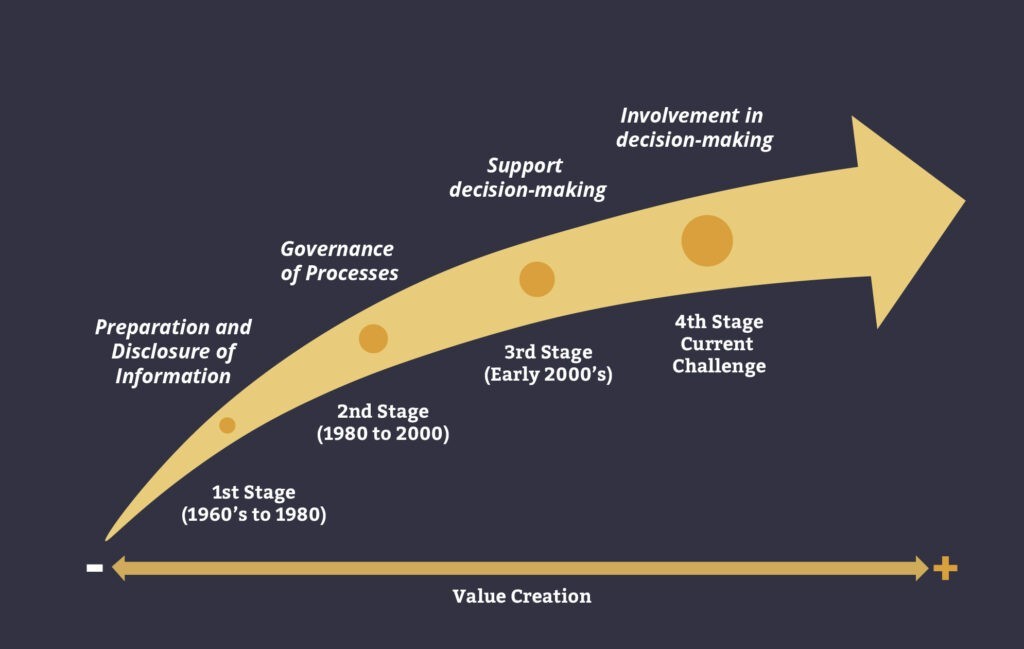

Before the 2000’s, little was required from the Finance sector in organisations beyond the role of calculating results, consolidation, and reporting figures. The CFO’s scope of activities are more restricted: it was enough to have a good command of controllership, finance, and to be a good “numbers manager”. Following a series of corporate scandals that resulted in relevant legal changes, such as the Sarbanes-Oxley Act, the 2008 financial crisis and increased concern with rules of corporate governance; the requirements for performance and contribution of Finance sectors as a business partner have become greater.

The chart below shows the increasing role of Finance sectors over time, in which you can observe a move towards greater value creation for the business.

Today, the CFO and Finance areas are generally expected to actively participate in business decision-making, adding new variables and information that steer the company in directions more in line with the challenges and risks to better business performance.

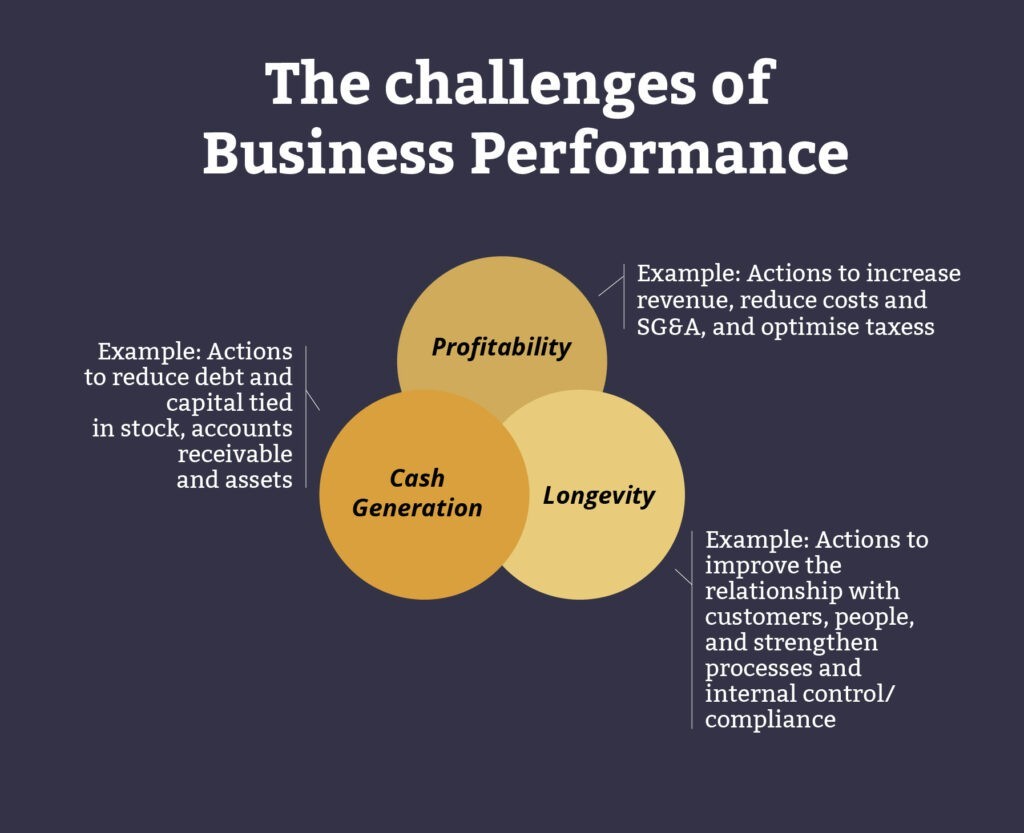

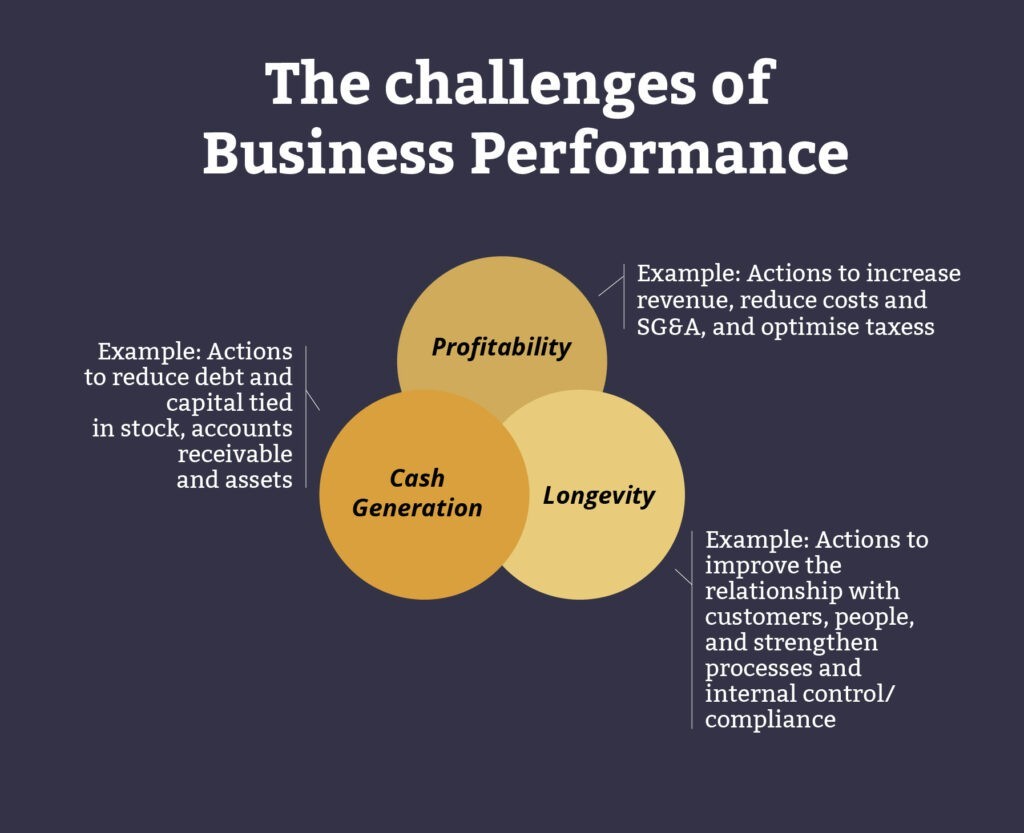

From the perspective of shareholders and C-levels with a vision of the long-term and business continuity, we understand the challenge of business performance in light of three key performance variables: Profitability, Cash Generation, and Longevity.

The new scenario for financial management brought to the forefront of discussions issues that were previously considered to be of minor importance, such as, the unrestricted commitment to Compliance which is no longer simply a fulfilment of regulation, but an instrument that ensures the longevity of the company.

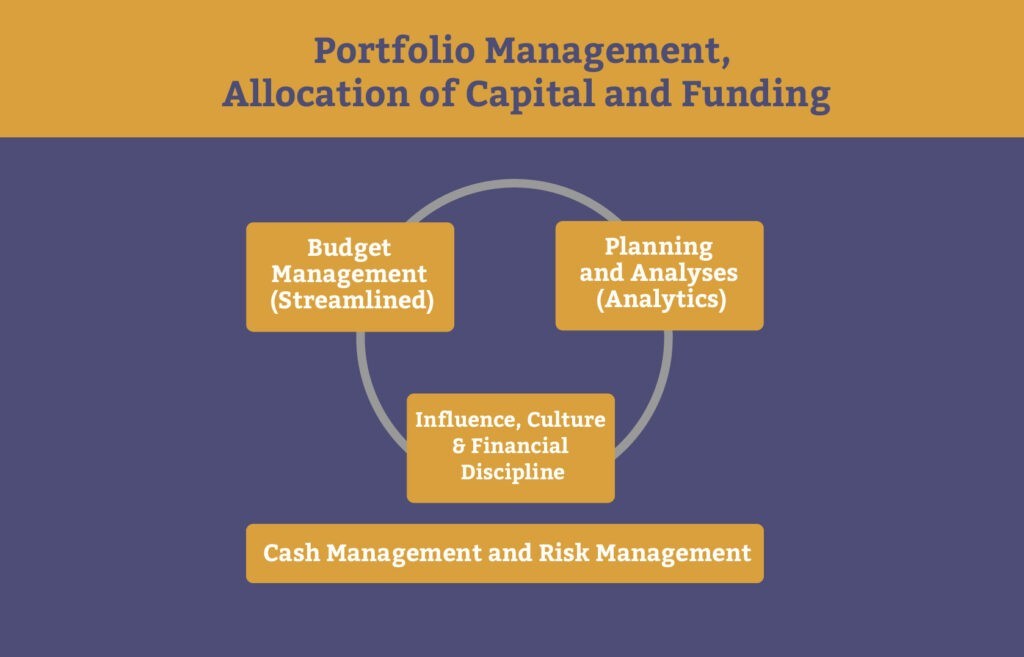

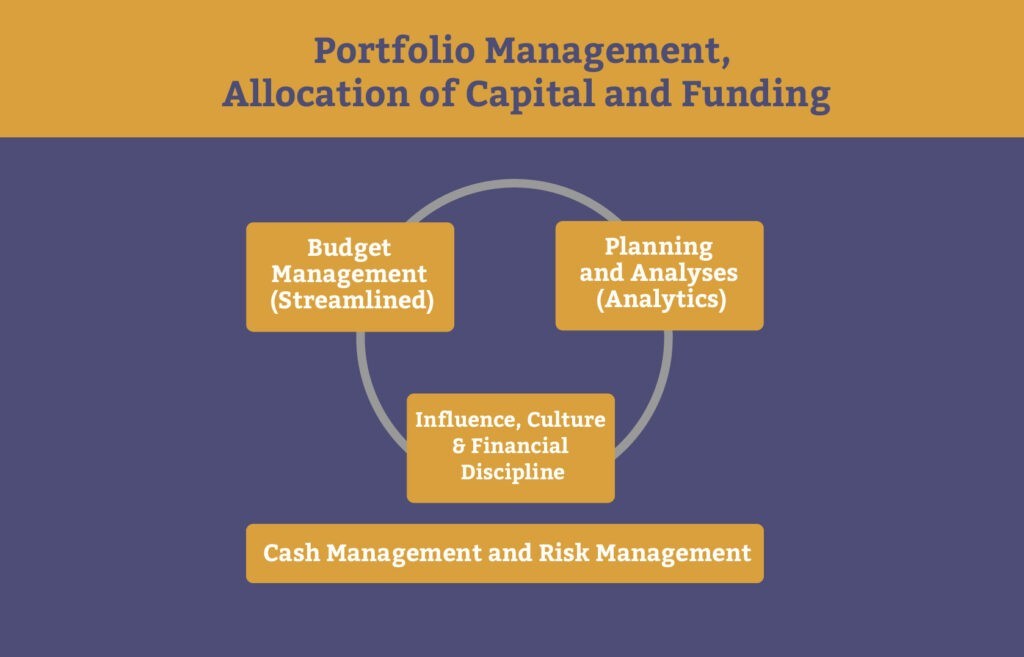

In late 2017, Visagio Research & Intelligence (R&I) conducted a survey on Financial practices in 44 medium and large-sized companies, interviewing C-levels and members of the board, and having as one of the results the construction of an initial model of Corporate Finance challenges, represented in the diagram below.

The proper orchestration of these key variables by Finance manager can contribute to the improvement of the company’s performance.

In this insight we will address the results of the survey focusing on 3 key variables:

- Budget Management – streamlining and control

- Planning and Analysis – commandment of data intelligence

- Influence, Culture & Financial Discipline – “thinking like an owner”

1. Budget Management – streamlining and control

Starting from macro to micro vision, we suggest a management model in which the development of a strategic plan and strategic initiatives culminate in budget management. The more streamlined the budget is, the greater the benefits tend to be.

The streamlined budget should contemplate the budget from scratch and make use of practices, with an emphasis on ZBB (Zero-Based Budgeting) and matrix cost management (MCM) to redefine accounts with a volume/unit value ration.

The survey shows that 75% of participating companies stated that budget creation is linked to strategic planning. Of these companies, 60% begin the budget cycle after strategic planning.

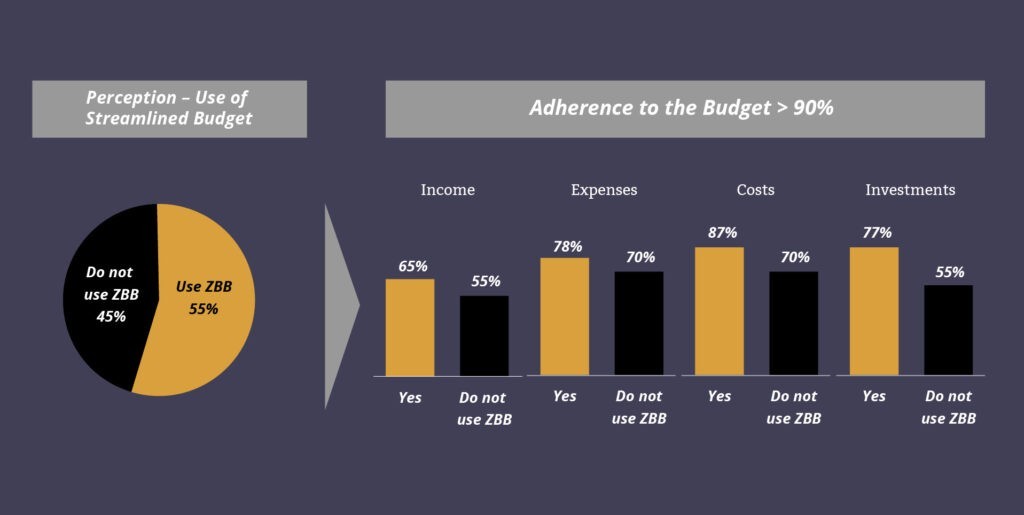

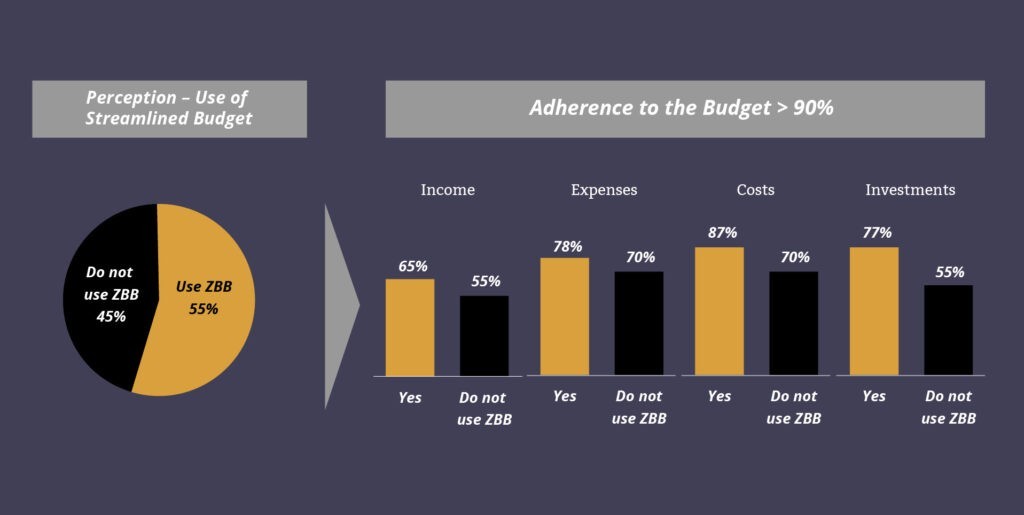

In addition, the results showed that adherence to the budget was greater in companies that use streamlined budget management. As can be seen in the chart below, the level of adherence to the budget was considered high for a larger percentage of companies when the company practices Zero-Based Budgeting.

2. Planning and Analysis – command of data intelligence

Creating structured databases in flexible formats is the first step to have analytical intelligence in the organisation. The next step is to have tools and professionals trained to generate analyses that assist and underpin decision-making. These attributes are critical for a FP&A (Financial Planning & Analysis) sector to add greater value.

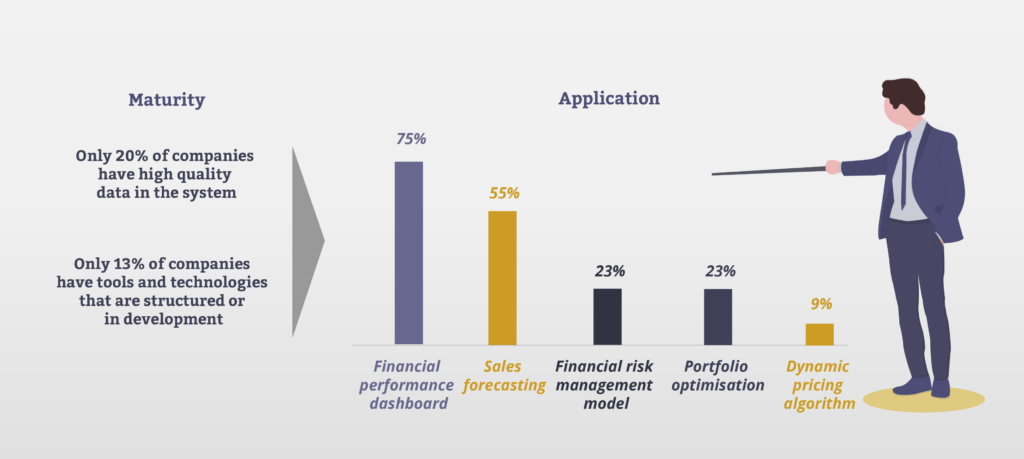

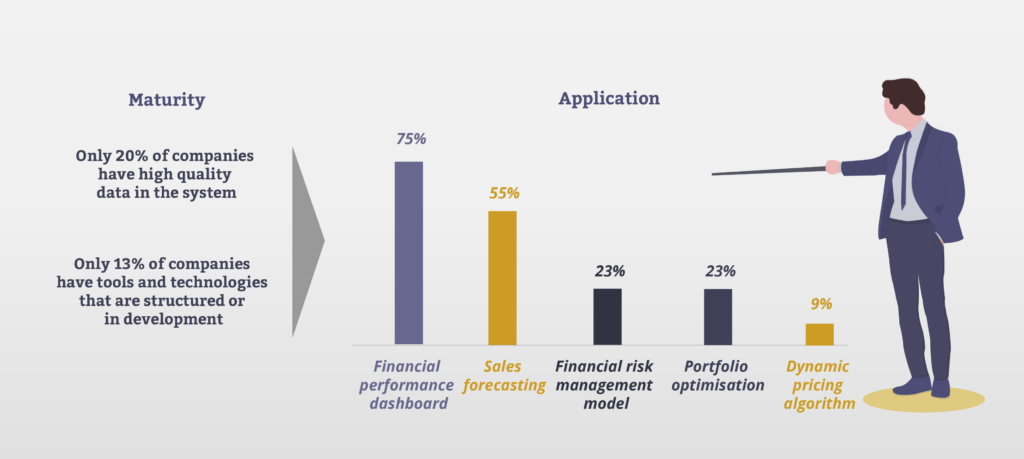

The survey (below) showed that companies from the sample still make little use of data analysis tools. In the chart below, you can verify that the use of Analytics is still incipient in the surveyed companies:

In increasingly dynamic markets, it is crucial that decisions are made, based on evidence and data. One of the most effective ways to do this, is through centres of excellence focused on continuous improvement and making use of Analytics tools. One discussion yet to be explored is if this centre should be embedded in the Financial sector.

Learn more about Analytics

Analytics is a generic term that designates a range of analysis that can be made in big data. The origin of this data can be in-house or external, and therefore encompass all the quantitative information the company generates (or should generate) internally, such as: sales, average ticket size, customer profile, and also the one it has access to externally, for example, demographic data, regional income, seasonality, and customer dispersion.

Among the major uses of Analytics, we can mention:

– Business Intelligence (BI)

– Analysis of behavioural patterns and root causes

– Sales planning and demand forecasting

– Process simulation

– Propensity and retention models

– Logistics network optimisation

– Inventory optimisation

– Production scheduling and sequencing

(http://visagio.com/pt/analytics)

3. Influence, Culture & Financial Discipline – “thinking like a owner”

The goal of financial discipline is to create a culture of accountability with corporate spending, where each individual in the organisation is committed and accountable for their results. Managers play a key role in the change and raising employee awareness. By “leading by example”, which requires abnegation of their behaviours and daily decisions, managers become the indoctrinators of financial discipline.

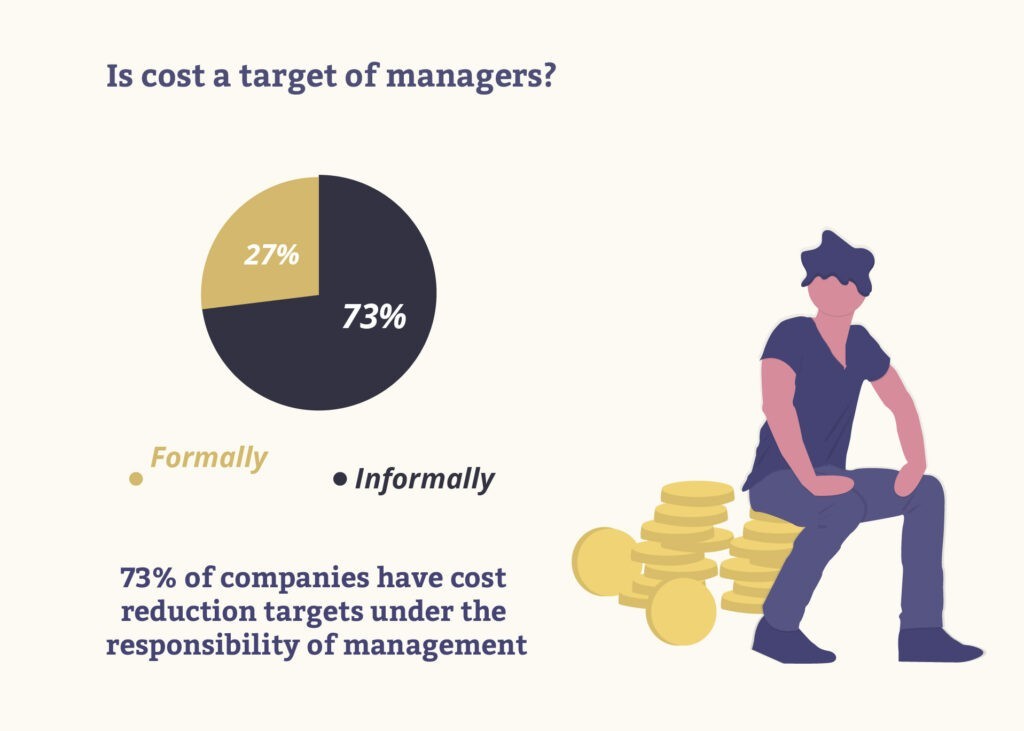

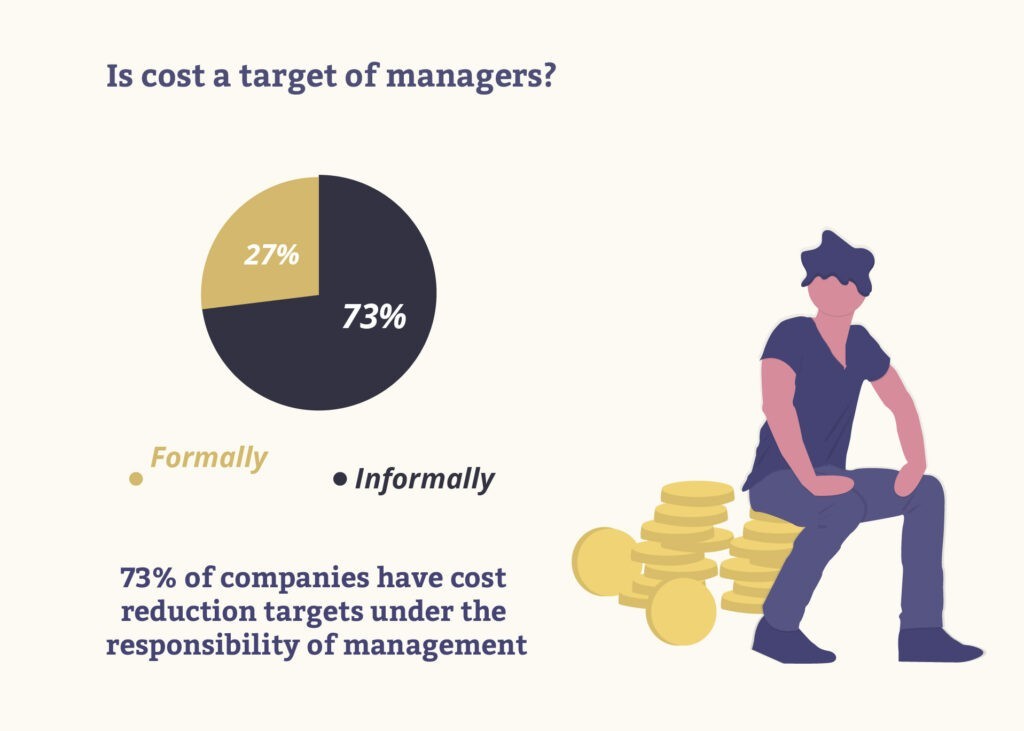

To ensure that managers are engaged in the culture of austerity and financial discipline, it is critical that “Cost” is among their targets. As seen in the survey conducted by Visagio Research & Intelligence, 73% of companies have “Cost” as a formal target for management, while 27% have “Cost” as an informal target.

In addition, an analysis was made on the maturity of the financial discipline of the companies surveyed and a correlation with budgetary adherence was made. The results are shown below:

One way of rewarding this culture is through meritocracy. The distribution of the company’s profits, with a reminder that savings are made on a day-to-day basis represents greater results for everyone in the organisation, encouraging and involving employees. This way, the culture of financial discipline begins to proliferate, creating a legion of “owners” committed to the company’s results above all else.

About the authors

Rafael Valente is a Managing Partner at Visagio, specialising primarily on organisational transformation projects, business planning, operational optimization and SG&A in various segments. He is one of the partners responsible for financial practices and organisational transformation within Visagio.

Murilo Bortoluzzi is a Visagio consultant, specialising in organisational transformation projects, finance, process reengineering and business excellence, with experience in retail, banking, and industry.