The three pillars for exploring how analytics benefit the finance department

Financial Analytics emerged from finance department’s needs to view and analyse data in answering business-related questions, as well as simulating and predicting possible future scenarios to support decision-making.

A maturity survey was conducted to evaluate best practices for analytics adopted by organisations within their finance departments.

When analysing a company’s analytics initiatives, it is crucial to evaluate three main aspects: culture & organisation, information & tools, and skills & competencies.

Culture and Organisation – The Importance of Incentive for Groups Focused on Analytics

To guarantee that the organisation has a mature finance department in terms of analytics initiatives, it is crucial that it values an analytical culture and is structured in a way that promotes the development and implementation of new solutions in the field.

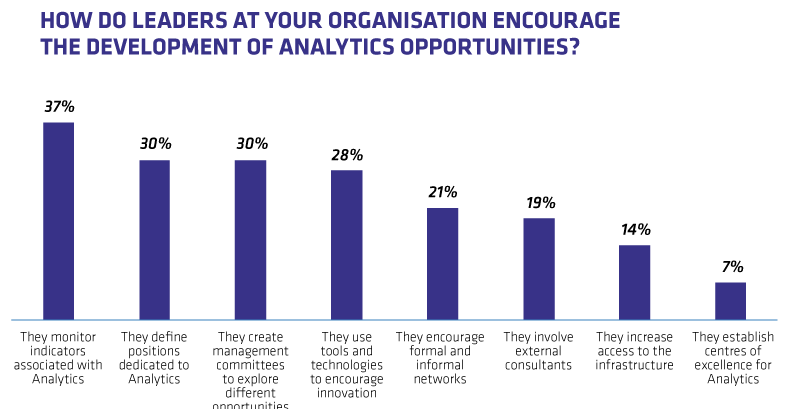

By analysing the culture of the companies participating in the questionnaire, it can be observed that the primary ways that leaders encourage discussion of this topic include: the creation of dedicated positions, specific forums to discuss new ideas and opportunities and the monitoring of indicators associated with analytics. This includes the number of implemented solutions, and the return on investment and benefits these initiatives have brought for the organisation.

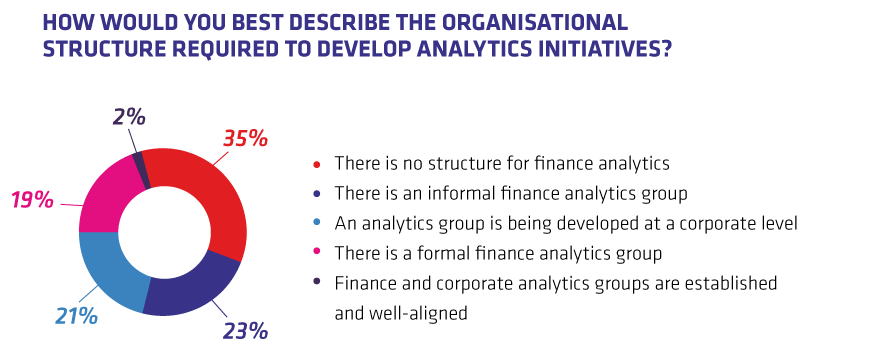

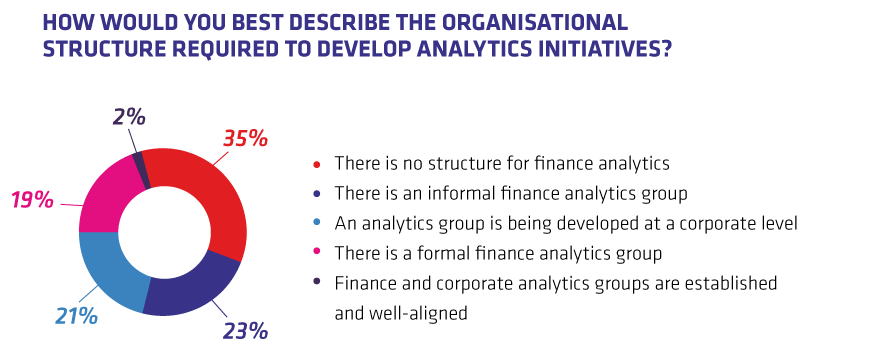

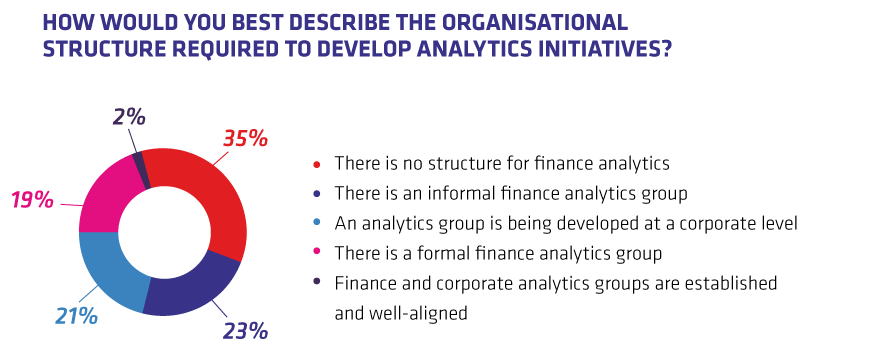

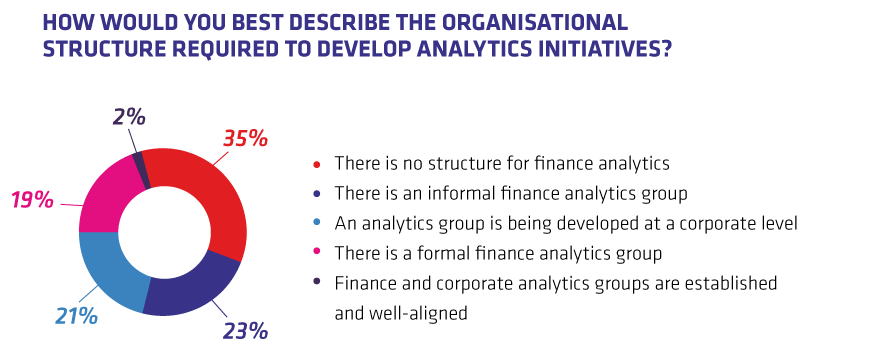

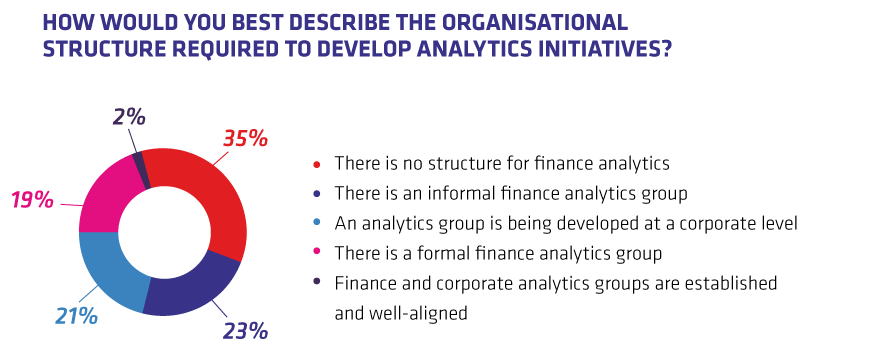

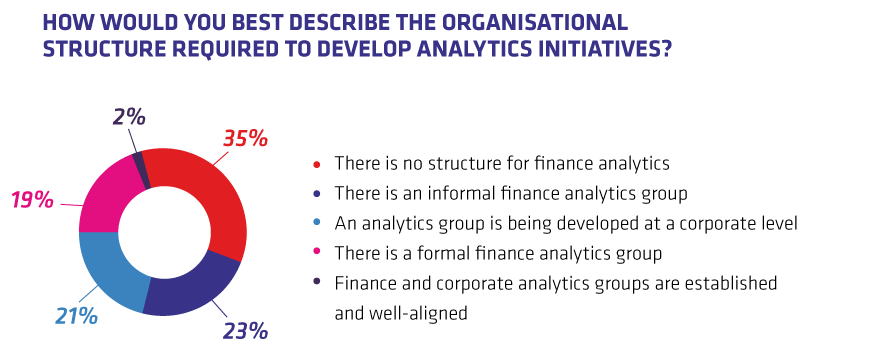

As for the structuring of Financial Analytics areas, it can be observed that 65% already work focused on the topic, even if this is only in informal groups. In 21% of the companies, the topic is treated formally, and the remaining 21% is working towards this model, attesting to the importance of this subject.

With the evolution of the analytical culture within companies, it is crucial for organisations to create mechanisms to encourage discussion on this topic. This will lead to an efficient focus, with an environment suitable for developing and implementing solutions in finance analytics. Another trend observed is the creation of centres of excellence in analytics – allowing for the horizontal development of initiatives, standardising and streamlining their implementation.

Information and Tools – Low Democratisation of Access to Tools and Data

When companies are assessed for the availability of analytics tools, it can be observed that, in approximately 89% of organisations, employees cannot easily access these tools.

Another point indicating that companies do not utilise the full potential of analytics solutions is the difficulty of accessing and handling the data. According to the survey participants, 40% have experienced difficulty accessing and integrating the organisation’s data, while 40% of companies understand the importance of having responsive data access and were developing initiatives to make data and information management more effective.

With the evolution of technology and increased quantity of data, for initiatives in analytics to be successful and repeatedly implemented, tools and data must be easily accessible to enable employees to explore the data, create new solutions and implement them efficiently.

Skills and Competencies – The Focus on Data Visualisation and Reports Structuring

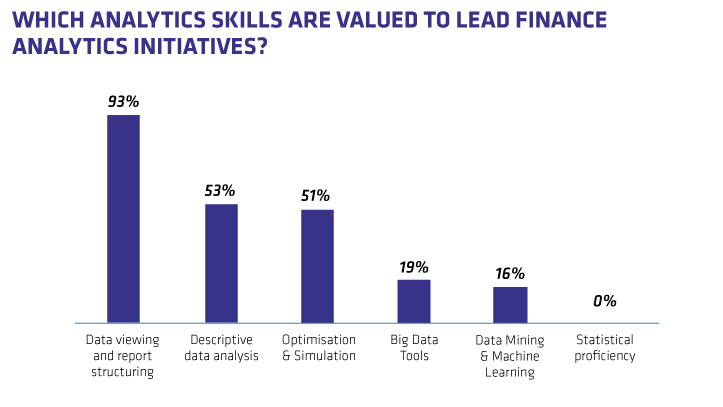

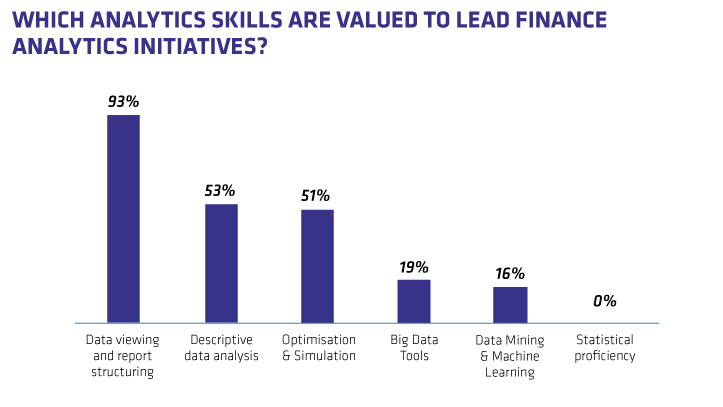

Approximately 93% of the companies participating in the survey have determined that the skill of visualising data and structuring reports was the most important financial analytics competency. This result confirms expected behaviour, since the main role of these structures currently is to conduct analysis and descriptive studies, i.e. studies that explain some previously occurring event. Another point supporting this conclusion is that over 70% of companies answered that the main application of financial analytics are financial performance dashboards.

With increased availability and reduced costs for data storage and processing tools, the development of solutions that use data mining and machine learning became increasingly more frequent, allowing for robust analysis using the millions of bits of transaction-related data that a company may generate, such as the statistical models for analysing credit and detecting fraud.

The success in developing a finance department with an analytical culture is based on three main pillars: the first reflects how the organisation and finance area values analytics. Based on this incentive, the second pillar guarantees that the information and tools are easily accessible to employees. Doing so forms a solid foundation that will support the third pillar; the development and implementation of initiatives through people with the necessary skills and competencies.

About the Author

Felipe Pena is a consultant at Visagio specialised in projects focused on Budget Management, Process Engineering, and Analytics in the acquisition and banking sectors.