How to rationalise and guarantee perpetuity when cutting SG&A expenses

Direct costs, which are associated with companies’ core business, are always under the spotlight. They are highly controlled and constantly reviewed, since they directly impact the offered product or service. Other expenses, that are not tangible and explicit, end up being like a drain, leaking little by little without anyone noticing, resulting in a company with low profitability.

A good example for these items that can impact on a company’s financial result are SG&A (Sales, General & Administrative) expenses. These expenses are related to business administration, including salaries, fees, travel, and other expenses from areas like Commercial, Marketing, HR, IT, Finance, Accounting, etc.

Reducing these expenses, paired with the adoption of more efficient budget performance management, can substantially boost the quality of the financial results achieved by an organisation. However, there are three main phases that should be followed to rationalise SG&A expenses in a healthy way – that is, without affecting sales and services for the business areas:

Identifying the potential for expense reduction

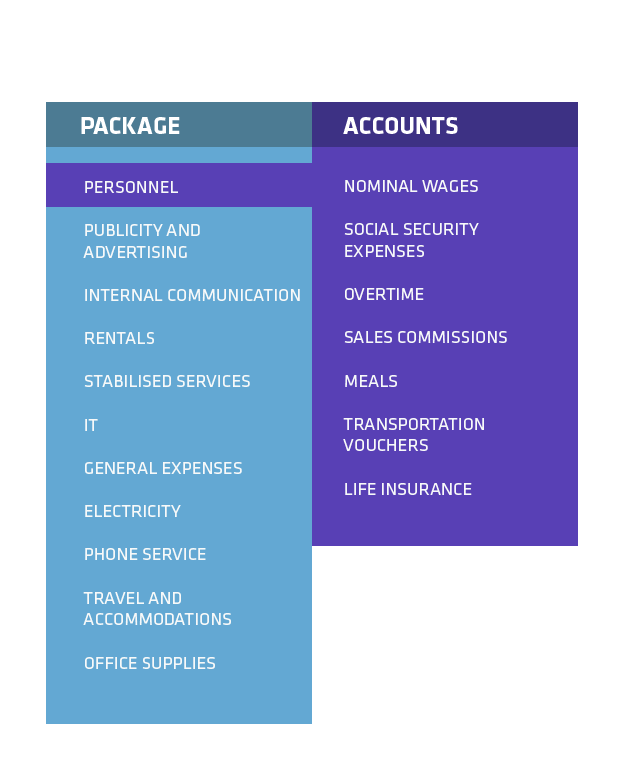

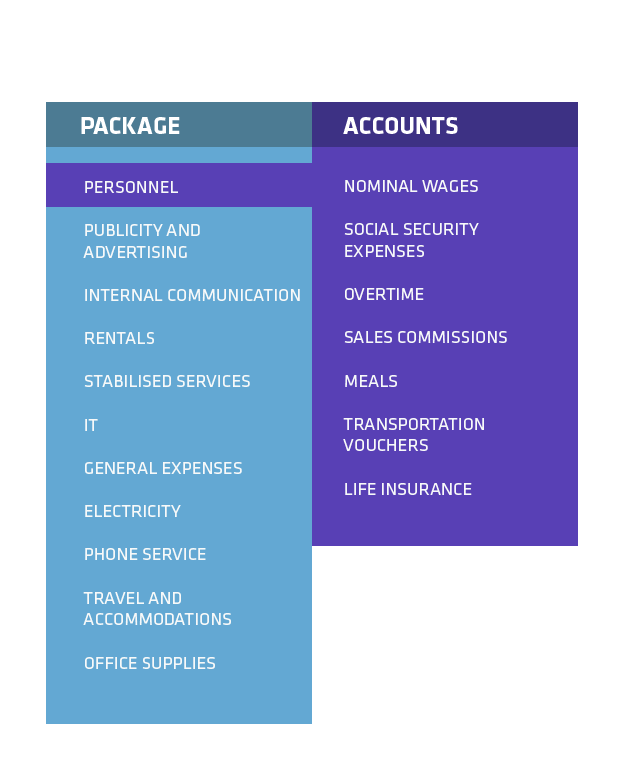

After defining the need to reduce SG&A expenses, there should be an assessment of the company’s main accounts. The accounts can be grouped into packages based on their profile to facilitate the impact analyses of each one and assess the effort required to reduce them.

Learn more: How to group a company’s accounts

A package is a grouping of similar accounts that helps the manager become specialised, making the monitoring more effective.

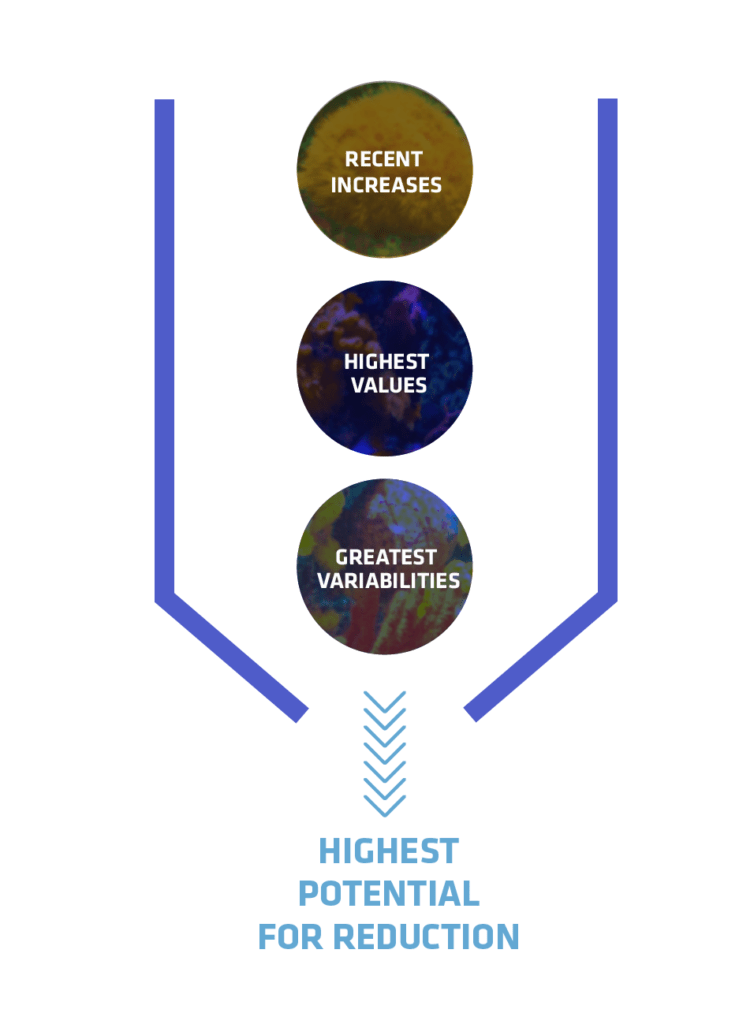

Once the accounts are grouped, it is important to prioritise those packages with the greatest potential for reduction. Accordingly, factors to consider include the total package value, recent significant increases, and their historical variability. The accounts with the highest values, recent increases, and highest variabilities are the main candidates for a more in-depth analysis and direct action, ensuring a real impact from reviewing these expenses in terms of the company’s overall costs.

Evaluating expense reduction actions

Once it is known which accounts offer the greatest potential for reduction, the next step is to determine internal and external benchmarks, comparing productivity and cost indicators. For this comparison, it is important to emphasise factors like location, scale, and segment of operations, together with other specific characteristics that may distort the analyses. This makes it possible to assess the efficiency of each area, as well as the company’s efficiency when using its resources.

When comparing the accounts, different hypotheses are considered to help resolve any problems. The hypotheses are tested, and once validated, there is an evaluation of the risks associated with the same and the ways these can be mitigated. This allows the company to propose improvement actions and measure the gains expected from these. These actions can be focused on process improvement, the implementation of new technologies, and organisational restructuring. The actions can be prioritised, considering the greatest gains and lowest level of complexity / lowest implementation costs.

How can you continuously cut SG&A expenses?

Just like any organisational change, when implementing the actions, the company should pay special attention to the aspects of change management necessary for guaranteeing its effectiveness. All the company’s competent areas should be accessed, such as, for example, Supply to replace suppliers, Legal to renegotiate contracts, HR to promote staff adjustments, etc.

Besides working initially to produce actions that will leverage the gain, the administrative areas should be monitored using indicators that reflect the impact these actions have over time. This indicator-based management ensures that the effect of the expense reduction actions be captured not only over the short term, but also over the long term.

Rationalising expenses with SG&A means spending less, but it does not necessarily mean doing less. Therefore, planning and control are very important. However, there is a factor just as if not more important: the company culture. The company’s constant focus on reducing expenses, reflected in individual attitudes, is an important tool for rationalisation. Besides these aspects, an efficient budget management process and creation of individual incentive mechanisms play an important role in terms of reducing the expense level. In this sense, one important tool is ZBB (Zero-Based Budgeting). This is a highly efficient tool for elaborating the budget, which also helps cut expenses.

About the author

Fabiano Muniz is a partner at Visagio and leads organisational transformation, operational optimisation, performance management, zero-based budgeting, and cost reduction projects (having worked in the retail, financial market, telecommunications, agroindustry, and automobile industry sectors). He is one of the partners responsible for finance practices, budgetary management, and cost reduction for Visagio projects.