Summary: Experimentation practices are well established in marketing and innovation as a method to enhance layout performance and therefore convert more leads. But how can it be applied in Credit and Collection policies (and why they should be)?

Building a culture of experimentation within a business is a transformative process that extends beyond merely adopting new tools. It requires a fundamental shift in mindset, prioritising curiosity, data-driven decision-making, and democratised innovation. Global companies like Booking.com, Amazon, and Google have demonstrated that fostering an environment where all employees can propose and run experiments leads to significant advancements and competitive advantages. In the banking sector, adopting a similar culture of experimentation can drive innovation, enhance customer experiences, and improve operational efficiency. This article explores how core bank sectors can effectively build and leverage an experimentation culture to achieve these goals.

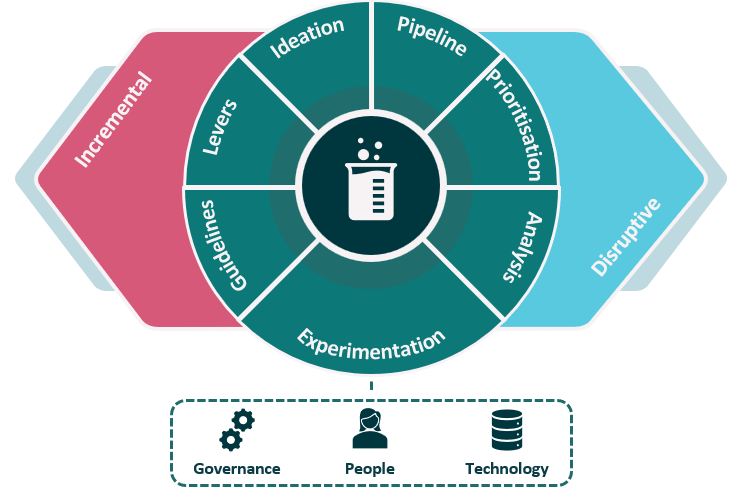

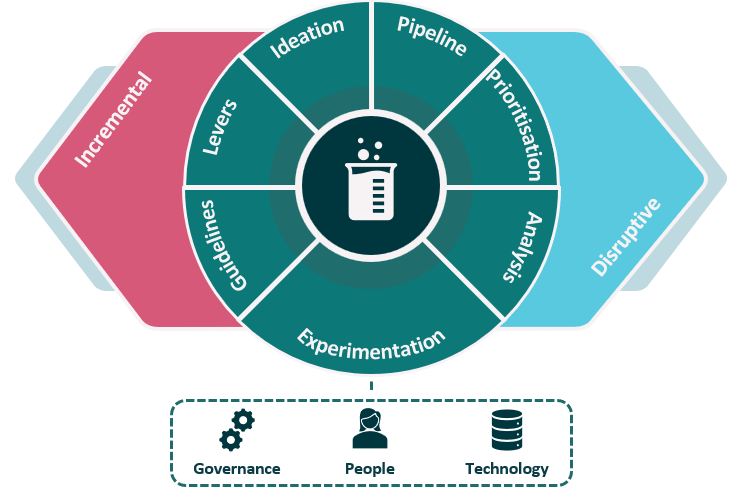

Visagio’s methodology of growth and innovation

Visagio’s approach to innovation and growth emphasises a structured cycle of experimentation applied to both incremental and disruptive ideas: experiments with existing data and innovative ones with new data sources. The core of this approach is three pillars: governance, people development, and technological advancement.

Key Components

Experimentation Cycle

- Guidelines and Levers: Establish guidelines and identify key drivers to ensure experiments are aligned with strategic goals.

- Ideation, Pipeline and Prioritisation: Generating new ideas through dynamic and engaging activities, building a structured funnel for ideas to be evaluated and prioritised, and using the ICE Score (Impact, Confidence, Effort) to prioritise initiatives.

- Experimentation: Implementing and testing ideas in controlled environments.

- Analysis: Evaluating results and iterating based on data.

Pillars

- Governance

- Ensure strong governance with a clear framework to support dynamic operations and alignment towards results.

- Utilise agile methodologies, including regular sprints and meetings to maintain progress and address any impediments.

- Incorporate stakeholder feedback and ensure continuous improvement.

- People Development

- Build a multidisciplinary team with strong technical capabilities and continuous training.

- Promote a culture of collaboration and knowledge sharing within the team.

- Develop leadership through hands-on experience and structured training programs.

- Technology

- Develop tools to automate the tracking of results and ensure consistency across experiments.

- Implement dashboards for real-time monitoring and analysis of experiments.

- Ensure robust data management practices to support informed decision-making.

Proven Success

Visagio’s methodology has been successfully implemented in various core banking areas in Brazil, showcasing significant financial results:

Case Study: Credit and Collections Lab

The application of this methodology in a medium-sized financial institution in Brazil resulted not only in clear and measurable financial benefits but also in a mindset change within both the credit and collections divisions. This brought to light the necessity of applying the correct procedures when analysing and executing A/B experiments (split testing consisted of two randomised groups, test and control) in order to guarantee accurate takeaways, while also highlighting the benefit of building a team that can become a reference in terms of experiment conduction best practices and innovation.

- Results:

- AUD 0.9 MM/month in collections improvement within 12 months.

- AUD 1.9 MM/month in new credit production within 8 months.

- AUD 0.7 MM/month in granted credit limits within 2 months.

- Approach:

- Agile and multidisciplinary teams focused on generating insights through structured experimentation.

- A data-driven culture ensuring robust experimentation pipelines supported by analytics and data models.

- Incremental and disruptive innovation through new policies and ecosystem partnerships.

- Development of automated tools for management and scalability of experiments.

- Strong governance to prioritise, execute, and monitor tests with an internal training program.

Conclusion

Incorporating an experimentation culture within core banking sectors is essential for staying competitive and responsive to market changes. This methodology provides an illustrative approach framework for implementing such a culture, ensuring that banks can systematically explore new ideas, validate their potential and scale successful innovations. By focusing on governance, people development and technological advancement, banks can create a resilient and adaptable organisation poised for long-term growth and success.

Would you like to build and leverage an experimentation culture inside your organisation? Get in touch at contact@visagio.com.

References

Building a culture of experimentation

About the authors

Matheus Sierra is a Visagio consultant with experience in Banking Credit Risk Management and Data Analysis. He comes from a background in Mechanical Engineering, having studied at the University of Campinas, Brazil. He has worked on various projects in the Brazilian banking industry, one of them being the implementation of a Credit Innovation team in a medium-sized financial institution.