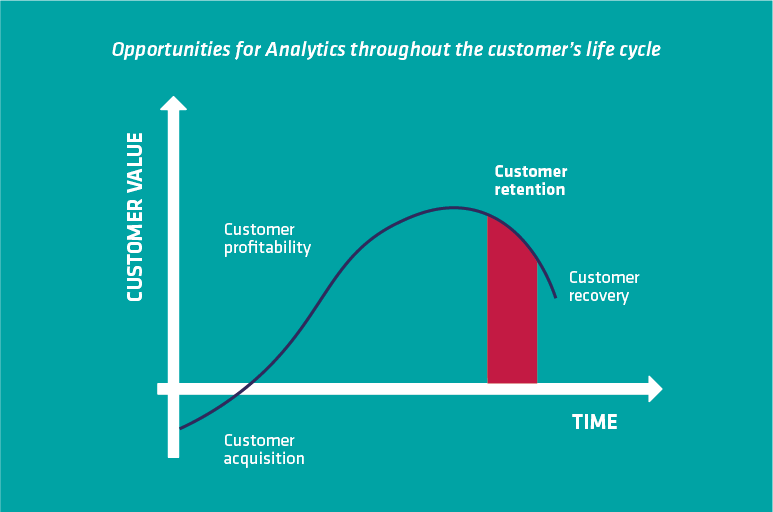

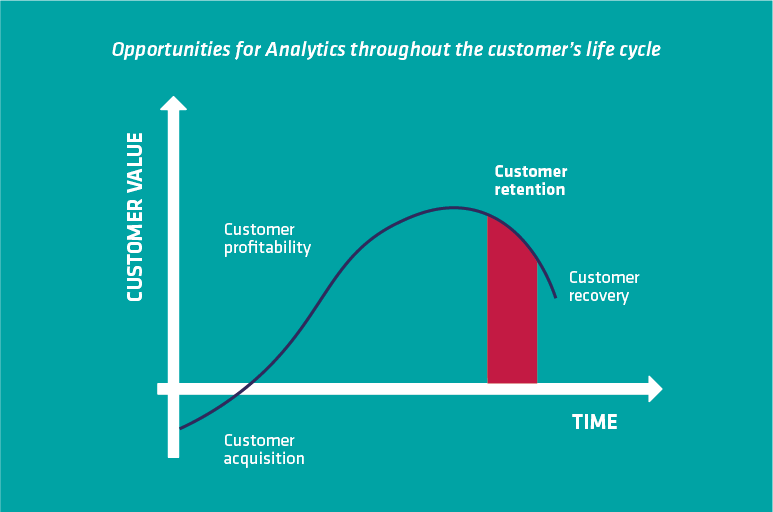

Have you ever imagined losing your customers? Knowing you are about to lose them, can you tailor your approaches to retain them? A few years ago, this seemed like an impractical task due to the restrictions on customer information and technologies that made forecasts with a degree of assertiveness. But today, with the growing adoption of Big Data & Analytics in organisations, the use of advanced analysis techniques for identifying opportunities throughout the customer lifecycle has become an increasingly common practice. As shown in the chart below, we’ve highlighted the opportunities in using these techniques to leverage efforts related to the customer lifecycle.

Learn More: about Big Data & Analytics

Big Data refers to a very large and/or complex set of data. Through well-developed techniques that are already widely marketed through cloud services, Big Data allows you to work on this large volume and variety of data at high processing speeds.

In turn, analytic techniques, represent a work of intelligence and analysis of these large volumes of data, structured or not. Interpreted by high-performance software that allows for cross-referencing this information at high speeds and the techniques that assist and support decision-making.

Machine learning methods have been widely used to predict the loss of customers. This technique uses algorithms that process large volumes of data to identify patterns of interest and thus make predictions. For customer retention, machine learning methods can be employed to understand the behaviour of customers right before the churn. Identifying behaviour similar to the established pattern allows you to concentrate efforts on actions specific to retention.

Generally speaking, a good prediction of customer attrition — combined with a targeted business approach can deliver great results for companies. Focused customer retention actions, such as the renegotiation of prices or offers of benefits, can prolong the customer lifecycle and offset the cost of the activities developed.

How do you predict customer attrition?

Before applying any analysis, it is important to reflect on what causes a customer to stop being one. The reason for leaving, may directly be related to their experience with the company. In other words, and, consequently, be understood by an analysis of negative expectations and frustrations customers may have had with the product or service from the beginning of the relationship. Only by understanding the causes, can you establish the initial goals for developing a predictive model, i.e. based on results and known behaviours, you can develop a model that can be used to predict future results.

Once you understand the causes that lead to customer attrition, you can collect information that allows you to predict churn. This information may vary from one company to another and depends on the relationship established with the customer – contract, subscription, purchase on the spot, among others. On the whole, the factors that predict loss can be grouped into 5 categories: customer profile, cost of change, marketing activities, competition, and customer satisfaction.

Learn more: Categories of information with the potential to predict churn

There are several examples of how the customer profile can affect churn. Some examples verified in studies show that higher-income customers are less prone to churning – perhaps they are less sensitive to price variations, such as the rural population. Less educated people, in turn, have higher churn rates. It is important to carry out additional assessments to identify patterns of specific profiles for the analysed case and not simply use the examples mentioned here or in other studies.

The lower the cost for a customer to switch to a competitor, the more prone they are on making this shift. These costs can by psychological, which include inactivity, brand search, familiarity, and a sense of rapport, with the current company, or physical, which are those truly related to value or the effort to change.

Discounts and rewards from loyalty programs are linked to lower churn rates, and businesses with tailored products have less churn than those with “one size fits all”.

Competition can occur within a category when, for example, it occurs between different subscription-based television operators, or between categories, such as what happens in subscription-based television operators with the growth of online streaming services.

It is intuitive that satisfied customers are less prone to churn, and this theory is proven in several studies. However, a generic measure of customer satisfaction might not be so closely related to churn. It is important to have specific indicators on customer satisfaction such as, for example, if the product meets expectations, whether it meets the customer’s needs, or if the price is adequate, etc. As this information is difficult to obtain, previous purchases and usage behaviours are often used as substitutes. In addition, you can include customer service calls and complaints as data for evaluating customer satisfaction.

A series of assessments should be carried out to identify factors that are truly relevant in predicting churn, and the information collected should then be submitted to machine learning methods. Different techniques can be used, such as decision trees, regressions, and neural networks. These algorithms seek to identify a customer’s patterns of behaviour before they leave and are thus able to estimate if they are prone to churn.

After identifying customers at greater risk of leaving, these are usually prioritised for the development of retention activities according to criteria such as the probability of leaving, as well as their worth to the company. The use of control groups that are not subject to any type of retention activities is also a common practice to serve as a basis for comparison and for measuring the performance of predictive models.

Case study on churn prediction in a financial services company

The use of machine learning for predicting customer churn can be illustrated by a recent case in which Visagio had the opportunity to assist. A financial services company identifying the customers that were most likely to cancel their services. The company was facing a growing challenge of retention, mainly due to the reduction of entry barriers previously established by industry regulators, allowing an increasing number of competitors to seek room in the market.

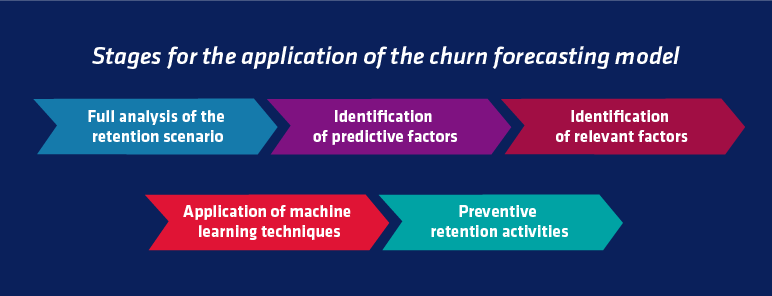

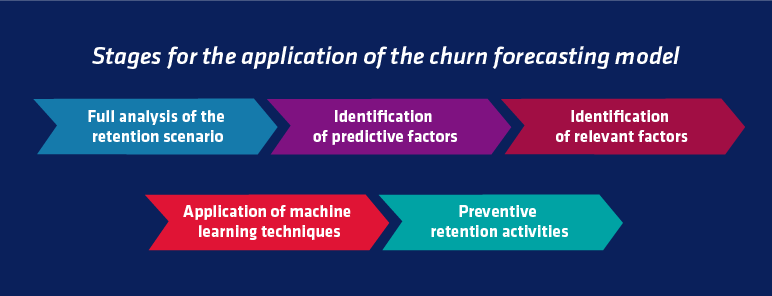

Before beginning the predictive model, an in-depth analysis was made of the customer retention scenario in the company, identifying the profile of customers who leave, the rate of attrition, and the performance of customer retention activities in progress. More than 200 potential predictive variables related to the profile and behaviour of customers before the churn were identified by mapping interactions and possible frustrations customers may have had with the company. By studying the correlation of each one of these variables with customer attrition and its importance in explaining the phenomenon, it was identified that 10 were relevant to the prediction of the event. The application of different machine learning techniques in the information collected, together with the process of building and adjusting the predictive model, resulted in predictions with a performance approximately 7 times higher than the technique in use for selecting customers in preventive retention activities.

Machine learning is not a silver bullet against churn

The market has already proven the use of advanced analysis techniques, such as machine learning, to be powerful tools in assisting organisations with its customer retention. Companies are increasingly investing in areas dedicated to the development of assessments of this nature and are achieving great results on customer information.

Machine learning methods for predicting customer attrition should not, however, be considered as a solution to this problem. Although predictive models provide valuable information to direct customer retention activities, customer loyalty will only be truly maintained through good experiences and perceiving an actual competitive advantage over competitors.

About the authors

Gilberto Cordeiro is a partner at Visagio, specialising in projects focusing on Analytics, and with experience the health, financial, mining, and agribusiness sectors.

Michael Schardosim is a Visagio consultant, specialising in projects focusing on Analytics, and with experience in the financial sector.