Why are smaller companies so sensitive to crisis?

Guaranteeing competitiveness with less financial flexibility is one of the greatest challenges faced by small and medium-sized companies. This factor, paired with internal processes with a low level of maturity, can halt the company’s sustainable, long-term development.

Changing the mindset in four steps

The first option companies explore during hard times is improving their cost control. However, it is not always enough to simply cut costs. Internal management processes and the allocation of costs should be reviewed to boost efficiency and ensure the resources are being allocated to the initiatives that matter.

The review of internal management processes is an efficient tool for optimising expenses. It is not enough to simply try and cut costs.

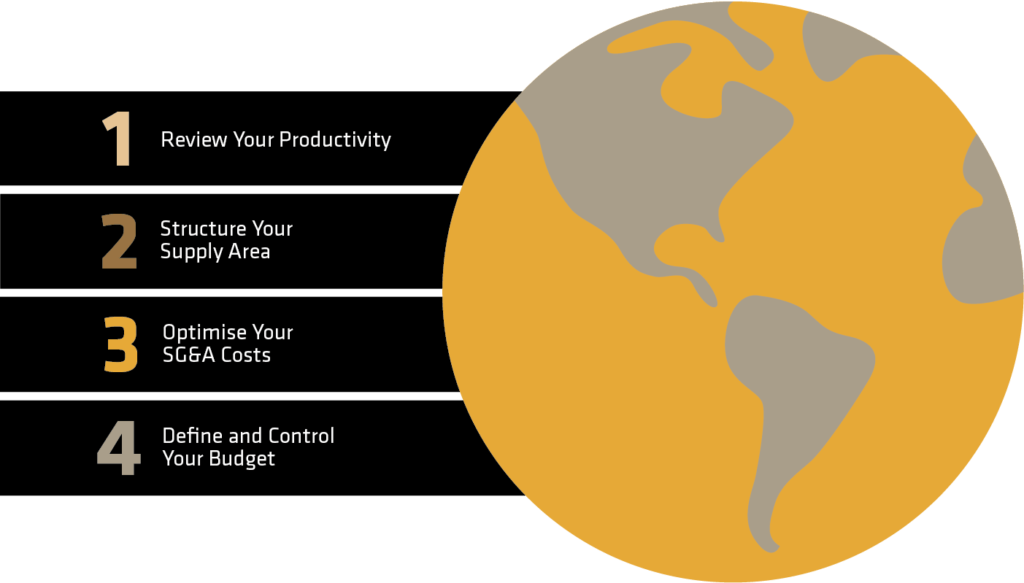

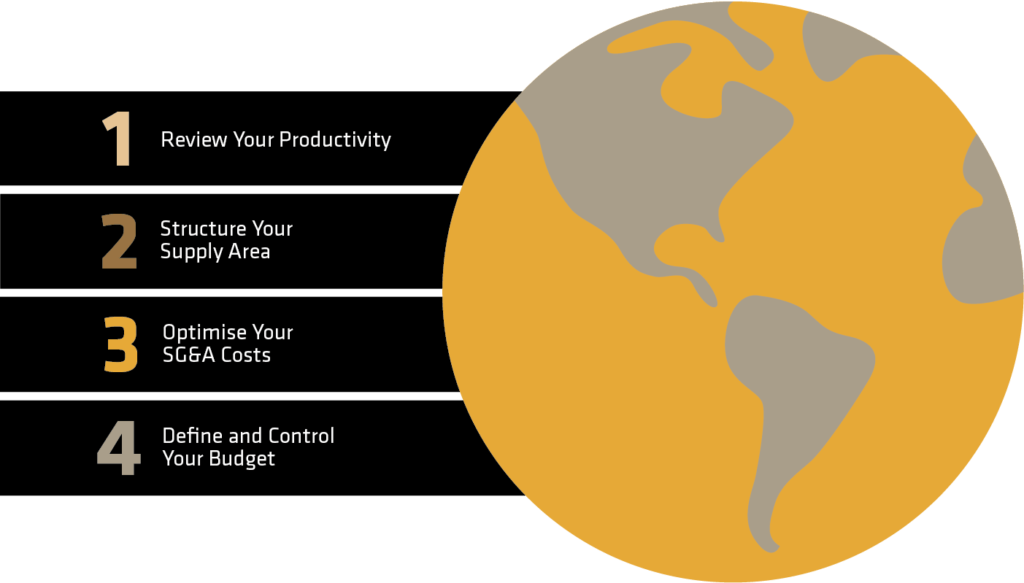

The methodology below shows four steps that can help you reach this objective:

- Review Your Productivity

One of the main opportunities for cost optimization involves implementing actions that help boost the team’s productivity. Productivity gains demand time, effort, and in most cases, investment. To ensure the success of the initiative, it is crucial to define goals, seek opportunities for synergy between departments and use good internal and external benchmark references when evaluating the company’s efficiency.

- Structure Your Procurement Department

The Procurement department shouldn’t be bureaucratic nor exclusively responsible for contract management. Rather, it must play a strategic role in the organization. This change in mindset can be achieved by focusing on three pillars: performance, people and supplier management.

Clear and well-defined KPIs ensure the procurement team is attentive to the entire supply chain and is generating the expected benefits for all links of the chain. These results are only obtained fostering improved team professionalization, with well-defined goals for negotiators and a meritocratic remuneration model and recognition mechanisms. Finally, creating a loyal and well-planned relationship with the supplier enables centralisation and optimisation of the strategic purchases is a fast way to reduce direct and indirect costs.

- Optimize Your SG&A Expenses

The so-called SG&Aexpenses include general, administrative, and sales expenses. A common mistake made by companies is focusing entirely on cutting operational costs and failing to consider possible savings with SG&A expenses. Disseminating the feeling among employees that they are owners of the company is an essential practice for naturally eliminating higher and unnecessary costs.

- Define and Control Your Budget

A key factor leading to the failure of many companies is the absence of a clear budget for each department, making it hard to predict and control the company’s financial results.

The first step for ensuring that the budget will be feasible, yet lean, is to elaborate it using a methodology that is suitable for the company’s current situation. The first way to define the budget is with Zero-Based Budgeting (ZBB), based on an evaluation of the labour and material needed to achieve projected revenue goals. The second method is the traditional budget, based on the amounts spent during prior months.

Learn more: Zero-Based Budgeting

The advantages and disadvantages of Zero-Based Budgeting:

Advantages:

– Allows for efficient resource allocation

– Prevents inflated budgets

– Focuses on projects and processes that are aligned with the company’s objectives

– Improves communication and organization within the company

– Increases flexibility and innovation within organizations when faced with possible restrictions

Disadvantages:

– Takes longer than the traditional budgeting, with justifications for all items on the budget;

– Requires managers to undergo specific training

Once the budget values are defined, it is vital that an expense control process is structured based on compliance indicators, which should be monitored during the course of the year and tied to the managers’ goals.

To summarise, efficient expense reduction constitutes a competitive differential for smaller companies working to ensure that hard financial times do not affect their strategic objectives. This, however, is a long path and requires efforts not only related to procedural and financial management, but primarily to the company’s internal culture.

About the Author

Pedro Faria is a partner at Visagio specialised in process redesign, organizational restructuring, budgeting, and data analytics projects. He has experience in the mining, infrastructure, and manufacturing sectors, among others.