Introduction

Around the globe, a movement is forming and gaining steam: to make the Earth a greener and sustainable place with net-zero carbon emission. This emerges from the brutal fact that humans are altering Earth’s habitats at an alarming rate to the point that 35th International Geological Congress in 2016 designated Anthropocene as an official geological epoch. António Guterres, United Nations (UN) Secretary-General, declared decarbonisation as the world’s most urgent mission, citing the recent records on temperature rising, Arctic sea ice disappearing, biodiversity collapsing and ocean warming.

The world is reacting quickly on different fronts, and the discussions happening at the Glasgow Climate Change Conference (COP 26) are a powerful example of the worldwide commitment towards net-zero emissions.

In this Insight, we will discuss how the mining industry is acting to reduce its carbon footprint through fleet decarbonisation using new technologies and advanced analytics approaches. Before we go deeper into the topic, let’s contextualise two important scenarios: politics and economics, and the green movement in mining.

Politics

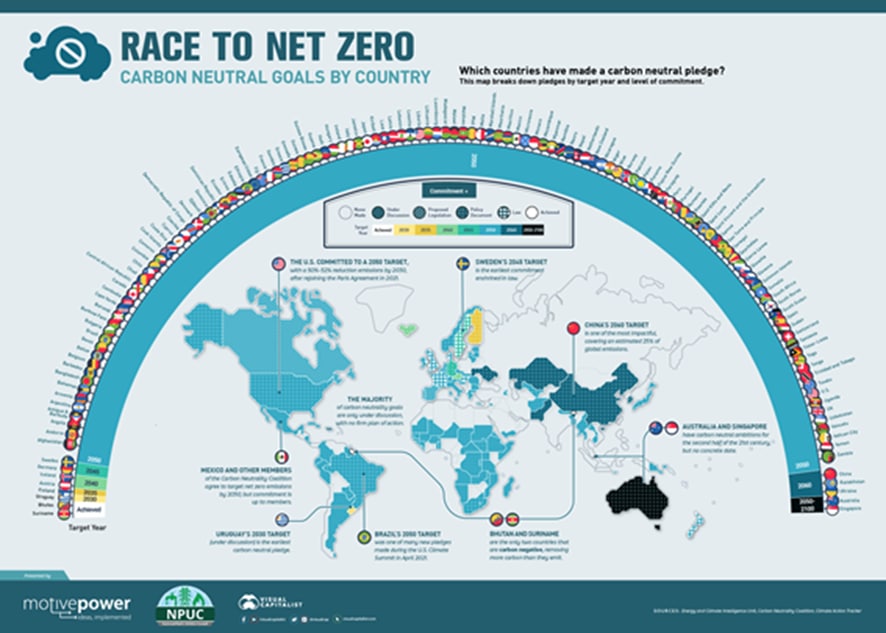

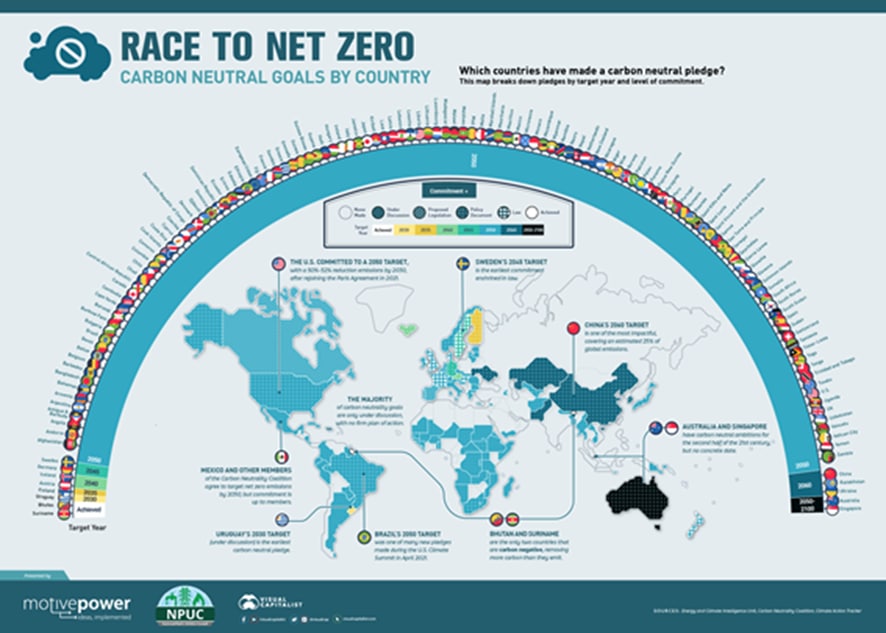

Nations and politicians are showing their strong commitments. At the UN level, the Paris Agreement, negotiated by 196 state parties and as of July 2021, signed by 191, sets the goal of reaching net-zero carbon dioxide emissions by 2050 to keep the mean global temperature rise to well below 20C above pre-industrial levels. In the United States, the Green New Deal, which has been gaining popularity, proposes ambitious goals to replace fossil fuels with renewable energy. Europe has its similar version, called the European Green Deal, in a quest to make Europe the first climate-neutral continent.

Economics

Decarbonisation requires significant capital investment to build new carbon-zero energy sources, build distribution infrastructure, and adapt or replace existing fossil fuel-based equipment. In the short-term, impacts on local economies are mixed as jobs gained from investment projects are offset by higher energy costs. In the long-term, most studies agree that decarbonisation will bring on a net gain of jobs and GDP growth.

Green Movement in Mining

Following a cross-industry trend, the Mining industry also started to act on the same concerns from regulators, investors, customers and the community. Currently, sustainability and decarbonisation became one of the top priorities of Mining CEOs. Most global miners have publicly declared their commitment to net-zero carbon emissions by 2050, with some exceptions setting a more ambitious target of 2030.

- Scope 1 emissions are direct emissions from owned or controlled sources:

- Burning of diesel fuel in trucks

- Fugitive emissions, such as methane emissions from coal mines

- Scope 2 emissions are indirect emissions from the generation of purchased energy:

- Mining facilities running on electricity produced by coal-based power stations

- Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions:

- Emissions by consumers of mining products, such as steel makers burning thermal coal

Of the three, Scopes 1 and 2 emissions are largely within the control of mining companies, particularly their diesel-powered mobile mining equipment which accounts for 30% of GHG emissions of the entire sector. This is therefore an appealing area to tackle [7] and the focus of this article: Fleet Decarbonisation.

Fleet Decarbonisation

Mining companies have set goals in investment and a reduction in GHG emissions in the next decades. BHP, Rio Tinto and Vale have established a 30% reduction in scope 1 and 2 of GHG by 2030. In order to achieve this number many actions must take place, with fleet decarbonisation being one of them.

Replacing the diesel utilised in transport is one of the key points considered for the 2030 target, given the high contribution in scope 1 emissions. Nevertheless, replacing the fleet with electric consumption would also increase scope 2 emissions; thus the goal is not set in the overhaul of the fleet per se, but in the decarbonisation measures. Not only do companies have to plan the electrification, but also how to increase its low-emissions sources for electricity. Besides electrification, hydrogen is a potential candidate and primary interest of some mining companies, such as Anglo American. Similar to electrification, finding low-emission sources for hydrogen is one of the key challenges.

Mining companies are planning to reduce diesel consumption with alternatives like using conveyors, optimising their transportation routes, trolleys assist etc. Vale already implemented a pilot in route-optimisation tested with 50 trucks and reporting a reduction of 1.5 tCO2. Most mining companies consider the diesel displacement plan in phases, given the project’s high risk and high capital. Having this flexibility allows for more alternatives to be tested and rapid development with new technologies.

Many countries are establishing a carbon neutrality goal as well. The European Union, China, Japan and South Korea are examples with targets ranging from 2050-2060 discussed as climates policies. China, one of the biggest iron markets, is already reducing steel production in companies with low environmental performance.

The time horizon for mining companies also ranges in the next few decades, considering these countries account for most of their sales.

Complete decarbonisation is not a simple task but one that is being planned gradually as we go.

What do mines and communities get from it?

Mining exploration affects heavily on the community nearby, with some of the sites being as big as small cities. Thus, this big change in fleet would also influence the mine areas. First, we are looking into having more infrastructure for the ore processing on site, avoiding having to use transportation for all the steps in the process (one of the examples is the in-pit crush and convey). Not only that, but other changes such as the use of conveyor belts and trolley assists could be more widely implemented, changing the layout we have for some of the mines.

Also, in order to have renewable electricity for the fleet, most mining companies are investing in solar and wind energy. This action takes place reducing scope 2 emissions and could aid in supply for the community demands. For example, Rio Tinto is implementing new structures in Fort Dauphin in Madagascar, supplying clean energy for its operations and nearby communities. Most of these impacts are predictions, considering the fleet overhaul still has barriers to being widely implemented, but some of them are becoming real, especially in test sites.

Challenges

The currently most viable option for decarbonising fleets consists of battery-operated vehicles. However, this option brings along many challenges:

1 – The site’s power load will be heavily impacted and will need balancing.

2 – Bigger dependency on reliable and affordable sources of electricity.

3 – The exact increase in electricity consumption is very hard to define.

4 – For now, at least, storing more than a couple of hours of energy in batteries is still prohibitively expensive.

5 – Mining companies cannot do it alone. Miners will first need to find the Original Equipment Manufacturers (OEMs) and battery providers willing to embark with them on the journey. Newmont Goldcorp, for example, is in the process of shortlisting OEMs but is still “lacking a major battery provider”.

6 – If the miner is grid-connected, you cannot expect them to green the grid themselves, unless it’s a very large mine. There has to be a dialogue with governments, power suppliers and industries to discuss and plan the journey to be greener.

Some examples of decarbonisation in mining

The world’s first carbon-neutral open-pit mine is being built by Nouveau Monde Graphite. The mine is connected to a large amount of hydropower, which is cheap and clean, and has support from the Quebec government, who wants to be part of the electrification process.

An underground mine of GoldCorp’s Borden turned out to be 40% less power-hungry after electrification of the fleet, due to the less need for ventilation, according to the results presented by the Manager of Energy and Sustainability at the company. Nevertheless, according to Roth-Deblon, Head of Global Business Initiatives at Juwi, the analysis has to be taken on a case-by-case basis. And overall, the need for electricity will go up. The additional electricity consumed by the fleet will be bigger than the reduction in ventilation load.

Glencore Plc has committed to a Paris-consistent strategy and projected a 30% reduction in its direct and indirect emissions by 2035. The goal includes natural depletion of its oil and coal resources, while its 2019 capital expenditures were weighted towards energy transition materials (used in battery technology), including African copper and cobalt and Canadian nickel. Also, Glencore is making carbon capture and storage demonstration project in the Surat Basin. The project aims to demonstrate CCUS on an industrial scale and focuses on capturing CO2 from a coal-fired power station in Queensland and permanently storing the CO2 deep underground.

In mid-May, Brazilian miner Vale SA announced that it would invest at least $2 billion to reduce direct and indirect absolute emissions by 33% by 2030. Vale also established internal carbon pricing of $50 per tonne of CO2 equivalent for capital projects in late 2019 and created a Low Carbon Forum led by CEO Eduardo Bartolomeo to reduce the company’s footprint.

Rio Tinto is installing a 34-MW solar farm: On average, the solar plant is expected to supply all of Gudai-Darri’s electricity demand during peak solar power generation times and approximately 65% of the mine’s average electricity demand. With a new lithium-ion battery energy storage system, the solar plant is estimated to reduce the annual carbon dioxide emissions by about 90,000 tonnes compared to conventional gas-powered generation. This is the equivalent of taking about 28,000 cars off the road.

Anglo American’s Mogalakwena platinum mine in South Africa is expected to have hydrogen-powered haul trucks piloted in 2021 with an under-construction 3.5 MW electrolyser to produce hydrogen on site. The company expects to roll out this technology to the entire site’s fleet and subsequently to their global assets in the following years.

Return on investment

It is not clear the exact value of the return on investment of an initiative as Fleet Decarbonisation, as there are many factors to consider in investments as well as returns. But it’s clearly a global tendency, and it’s on the top items on CEO’s agendas. The sustainability of miners is increasingly a focus for the capital markets, with access to capital now more frequently dependent on sustainability. The cost of capital can be 20 to 25 per cent higher for those miners with the lowest ESG scores. Customers are increasing pressure for it, and it can be used as a differentiator to sell.

Advanced analytics approaches

To achieve their goals of decarbonisation sustainably and reliably, companies across the world have developed different ways of planning and analysing the feasibility and viability within their mining operations. The plan can often span a few decades as some technologies have yet to exist, and companies often are the driving force to encourage the development of such technologies. Some partial solutions to the problems include the electrification of the fleet and the introduction of renewable energies to the electrical grid. Below are a few ways to effectively apply a decarbonisation plan:

Simulation Models

To simulate the impact of moving towards decarbonisation, discrete event simulation models of existing or future mine sites can be replicated to measure the performance and requirements in the real world. Before building the simulation model, the first step is identifying the questions that need to be answered. Different questions can be asked such as: “What is the best energy source to resolve decarbonisation?” or “Is this feasible? If so, are there any barriers to implementation?”. While building the model, realistic assumptions and limitations must be applied to develop an accurate model. Lastly, iteration and documentation of the processes are used to find the outcome through different scenarios.

Optimisation

Linear optimisation takes a set of inputs to an objective function to find the minimum or maximum value of the evaluation of the function. Optimisation can be complex, depending on how large the problem is. A challenging part of adopting an optimal solution is to set appropriate constraints to bound the solution search, and if done wrongly will produce an infeasible solution. In decarbonisation, linear optimisation can answer questions such as the most cost-efficient way of adding new technology or infrastructure.

Data Science

With the abundance of information provided by many big mining companies in the field, valuable insights can be gained from analytics from current data. In the future, using data science, electricity demands from the grid in mine sites can be forecasted to intelligently manage the integration of renewable energy, which is often intermittent depending on the weather. The data provided can also reveal inefficiencies of current solutions and allow for better planning in the future when the mine site moves towards decarbonisation.

Conclusion

Decarbonisation is a challenge but also an opportunity for mining companies. There are lots of obstacles to overcome, with technology, capital investment, public demands, stakeholder and policy pressure to name a few. If executed properly, however, decarbonisation will become a critical competitive advantage that is hard for others to catch-up. It is fair to say that this movement will reshape the mining industry as we know and nobody would want to miss the train.

About the authors

Luan Mai is a Visagio consultant specialised in projects in optimisation, simulation, and data science with extensive experience in the mining industry. His most current projects are with tier 1 mining companies to deliver optimisation solutions for their supply chain network. He has published seven papers in ISI journals to detail his research on the application of operations research and machine learning on mineral industries. He holds a PhD in Mine Planning Optimisation from the Western Australian School of Mines, Curtin University (Australia).

Eduardo Possato is a Management Consultant at Visagio. He graduated from Universidade Federal de Santa Catarina (UFSC) in Control and Automation Engineering. Possato has vast experience in data analytics, digital transformation, and business development.

Danilo Saito is a Technology Consultant at Visagio. He graduated from University of Campinas (Unicamp) in Electric Engineering and has 4 year of experience working in various companies with process mapping, robotic process automation (RPA), ETL tools, database systems and cloud computing.

Victor Drummond is a Management Consultant at Visagio with experience in innovation, process mapping, change management and in industry sectors such as mining.

Kung Yan Toong is a Management Consultant at Visagio. He graduated from the University of Western Australia (UWA) in Civil Engineering. He has experience in data analytics, process automation, optimisation, and VBA tools.